In the rapidly evolving world of cryptocurrencies, the landscape of mining is undergoing seismic shifts. Cloud mining and hosting, once considered niche services, are poised to redefine profit structures by 2025. The interplay between escalating hardware efficiency, fluctuating coin values, and the increasing complexities of blockchain networks creates a multifaceted scenario. Miners, mining farms, and hosting providers must adapt swiftly to sustain profitability amid this transformation.

The cornerstone of mining profitability remains tethered to Bitcoin (BTC), the flagship cryptocurrency. Bitcoin’s proof-of-work (PoW) algorithm demands immense computational muscle, making the acquisition and operation of top-tier mining rigs essential. By 2025, expect the convergence of next-gen ASIC miners boasting extraordinary hash rates and energy efficiency to become the norm. These advancements will recalibrate profit margins, pressuring smaller miners to gravitate towards cloud mining or hosting services that aggregate resources and economies of scale.

Meanwhile, Ethereum (ETH) presents a unique dynamism. With Ethereum’s transition towards Proof of Stake (PoS) crystallizing in 2024, the traditional mining model for ETH cryptocurrencies is set for obsolescence. This paradigm shift means that by 2025, cloud mining platforms must diversify beyond Ethereum mining rigs or pivot to other PoW coins, such as Dogecoin (DOGE) or emerging altcoins that retain mining incentives. The hosting ecosystems will simultaneously have to evolve to accommodate this flux, offering hybrid solutions that support mining diversified portfolios of cryptocurrencies.

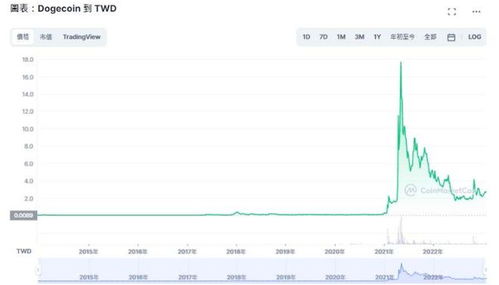

Dogecoin, despite originating as a meme coin, has carved out a legitimate niche as a PoW currency with energy-efficient, Scrypt-based mining rigs. Its low entry barrier attracts casual miners who often lean on cloud-based mining services to bypass hardware and electricity overheads. The interplay between DOGE’s community-driven value and mining reward structures ensures that hosting companies must innovate flexible, scalable models to cater to users seeking exposure to these alternative assets.

Mining farms embody the epicenter of profitability shifts. These mega-facilities leverage economies of scale, access to low-cost power, and hyper-automated control systems to maximize uptime and maintenance precision. By 2025, hosting providers will likely coalesce around hybrid models, blending cloud mining with on-premises infrastructure rentals. Such synergy enables diversified income streams, tapping into the volatile crypto markets while maintaining operational resilience against fluctuating energy prices and network difficulties.

As exchanges continue to mature, their integration with mining and hosting ecosystems deepens. Seamless interoperability among wallets, mining profits, and exchange liquidity creates a fluid cycle that benefits all stakeholders. Advanced user interfaces now allow miners to convert mined tokens into fiat or other cryptocurrencies instantaneously, while integrated analytics guide optimal mining strategies. This fusion of mining tech with financial infrastructure enhances the attractiveness of cloud mining and hosting services in the next era.

Given the relentless march toward decentralization, hosting models may also blur lines with decentralized finance (DeFi) protocols. Innovative agreements enabling miners to tokenize their mining power or hosting capacity could emerge, creating tradable assets on exchanges. This would democratize entry and liquidity, empowering individual miners and amplifying market speculation on mining capacity itself. Such networks could disrupt traditional profit paradigms by introducing dynamic pricing for hashing power and demand-driven allocation.

In essence, as the crypto mining ecosystem approaches 2025, no one-size-fits-all profit model prevails. Miners must navigate a labyrinth of technological upgrades, regulatory flux, and market sentiment. Hosting services morphing into flexible cloud platforms, embracing multi-coin mining, and integrating with exchange ecosystems will dominate the landscape. Successful actors will be those who anticipate volatility as opportunity—adapting hardware portfolios, leveraging data analytics, and fostering community synergy to propel mining enterprises into a new epoch of profitability and resilience.

This insightful piece delves into the transformative nature of cloud mining and hosting profit models, projecting a shift driven by technological advancements and market demands by 2025. It explores emerging trends, potential regulatory impacts, and the implications for investors and miners alike, making it a must-read for industry stakeholders.