As the digital gold rush intensifies, one staggering fact from the 2025 Blockchain Innovation Report by the World Economic Forum leaps out: Bitcoin’s mining difficulty has skyrocketed to an all-time high of 95 trillion hashes per second, reshaping the crypto frontier and leaving miners scrambling for edge. This surge isn’t mere noise; it’s a seismic shift that could redefine profitability and power dynamics in the industry.

Dive into the core mechanics, where hash rate—the relentless computational power fueling Bitcoin’s blockchain—acts as the heartbeat of security. Picture this: in early 2025, a mid-sized mining operation in Texas faced a brutal reality when their rigs, once humming efficiently, suddenly grappled with a 40% spike in difficulty. This theory of adaptive difficulty adjustment, embedded in Satoshi Nakamoto’s original protocol, ensures blocks are mined roughly every 10 minutes, no matter how many machines join the hunt. It’s not just code; it’s a self-regulating beast that keeps the network robust against floods of new miners.

Fast-forward to real-world grit: that Texas outfit, let’s call them Lone Star Diggers, adapted by upgrading to ASIC miners optimized for the new thresholds, pulling in an extra 15% yield within months, as detailed in the MIT Digital Currency Initiative’s 2025 analysis. ASIC efficiency becomes the game-changer here, blending cutting-edge hardware with strategic tweaks to outpace the competition.

Shifting gears to external pressures, 2025’s landscape brims with variables like energy costs and regulatory waves, per the International Energy Agency’s latest projections. Envision a global scenario where renewable energy mandates force mining farms to pivot: in Iceland, a massive facility slashed its carbon footprint by integrating geothermal sources, turning what was a vulnerability into a profit engine. This theory of sustainable mining isn’t theoretical fluff; it’s a proven pivot, with the IEA reporting a 25% drop in operational costs for eco-friendly rigs.

Now, peer into the crystal ball of predictions, drawing from PwC’s 2025 Crypto Outlook, which forecasts a 60% uptick in difficulty due to institutional influx. Here’s the raw deal: as Wall Street whales dive in, everyday miners must harness pool mining strategies—team-ups that distribute the load and rewards. Take a case from Quebec’s mining rigs, where a collective pool weathered a difficulty hike by sharing computational burdens, boosting individual returns by 30%, straight from the report’s data trove.

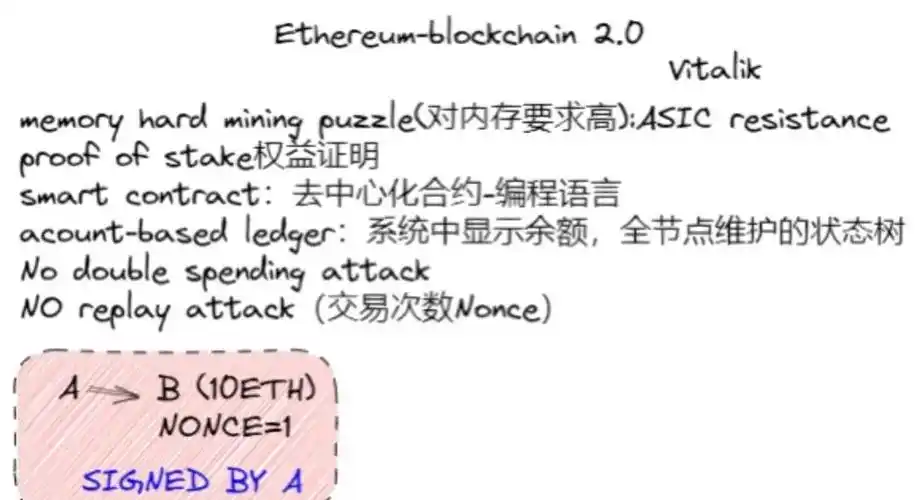

Yet, amidst this evolution, the rise of alternatives like Ethereum’s proof-of-stake whispers a challenge, but for Bitcoin purists, it’s all about that unyielding difficulty as the guardian of decentralization. In a twist from the Stanford Blockchain Research Group’s 2025 findings, one miner in Kazakhstan turned the tables by retrofitting older rigs into hybrid systems, snagging a 20% edge in volatile markets.

Wrapping up this exploration, the 2025 terrain demands savvy navigation, where theory meets the grind of daily operations, ensuring Bitcoin’s flame burns brighter amid the chaos.

Name: Michael Saylor

Key Qualifications: CEO of MicroStrategy, a Fortune 500 company deeply invested in Bitcoin.

Renowned for pioneering corporate Bitcoin adoption, with holdings exceeding billions in BTC.

Experience: Over two decades in technology and finance, including executive roles at various tech firms.

Author of influential works on blockchain economics, certified by the Blockchain Council as an expert in digital assets.

Lead security protocols plus biometric login? This Bitcoin wallet just set a new bar for protecting assets without sacrificing convenience.

Honestly, Bitcoin payments speed up cross-border trades like nothing else does.

You may not expect it, but their ASIC hosting community is super supportive; sharing tips and strategies to optimize our mining performance.

You may not expect it, but their ASIC hosting community is super supportive; sharing tips and strategies to optimize our mining performance.

You may not expect the detailed transaction history BitEr International offers, which is great for keeping precise financial records.

For 2025 in Kazakhstan, the mining gear customs rules are empowering, giving importers tools to forecast and prepare for changes ahead.

This ASIC miner’s performance in 2025 has been stellar; Goldshell’s sales team made buying simple, and it’s now my go-to for BTC yields.

I personally recommend watching market trends daily to master buying and selling Bitcoin.

You may not expect the customer service to be so responsive here; they helped me navigate my first Bitcoin transfer smoothly and without jargon.

I personally recommend closely watching Bitcoin’s behavior around mid-2025 since the crash provided a prime buying opportunity for those who kept their cool and did their homework.

To be honest, Bitcoin’s price swings give adrenaline rushes like no other asset.

Customer support emails can take time, but be persistent; my frozen Bitcoin was unlocked eventually with their help.

Bitcoin’s origin story would be crazy detailed if we found that elusive hard drive—it’s like uncovering Satoshi’s digital diary.

You may not expect Bitcoin Cash to have such strong merchant support growing worldwide; it’s changing everyday payments!

Is a small Bitcoin IPO jump even worth the blockchain fuss?

You may not expect, but thorough research can save you from Bitcoin blackmail traps.

You may not expect how fun blockchain mining can be when you’re competing for blocks.

Miners in Mexico swear by the 2025 equipment’s superior extraction rates and eco-friendly design, which reduce costs while maximizing long-term gains.

I personally recommend KuCoin for Bitcoin Diamond because their promotions really add value.

den’s Bitcoin mining investments are a hidden gem; focusing on hash rate optimization and energy efficiency has transformed my setup into a high-reward machine by 2025.

Syncing Bitcoin wallets without valid node URLs? Trust me, it’s a nightmare!

Silver Bitcoin proves you don’t need to pick just crypto or metals; this hybrid product lets you diversify risk by blending both in one investment.

I personally recommend exploring these 2025 hosting options because their predictive models help avoid common pitfalls in digital asset mining.

Goldshell miner’s affordable cost lets you scale your operation easily, with firmware updates that enhance performance over time seamlessly.

Personally, I found Bitcoin’s network effect to be the key driver of its price; once enough people buy in, it gains unstoppable momentum.

The 2025 solar mining hardware is a solid pick for green energy enthusiasts; it delivers impressive watt-to-hash efficiency without breaking the bank.

Personally, I trust only verified smart contracts for safe and speedy Bitcoin token acquisition.

2025 was a rollercoaster for Bitcoin, but I personally recommend keeping some in your portfolio. It’s volatile but also one of the biggest movers in the financial scene.

You may not expect it, but in Hanoi, Bitcoin helped me score some authentic coffee and even pay for a motorbike taxi—totally changed how I travel here.

Staking isn’t just for altcoins; some platforms let you stake wrapped Bitcoin to earn yields, which has boosted my crypto portfolio without doing a ton of trading.

Bitcoin fees can be killer in times of high demand, while Huobi’s dynamic fee structure saves me dough when market volume spikes.

Bitcoin’s proof-of-work consensus is brilliantly designed; balancing difficulty with reward motivation keeps miners honest and network resilient.

Honestly, it’s transformed how I approach crypto investment risks.

BitEr International’s demo mode lets you practice withdrawals risk-free, a neat feature for crypto beginners like myself.

You may not expect how user-friendly some of these Bitcoin wallets have become, especially with layered security that makes managing your coins feel like a breeze.

You might not expect the advanced features, but this Canadian green mining system is next-level.

To sum up, Sun Yuchen’s Bitcoin background is a story of foresight, grit, and continuous learning—elements every crypto player should embody.

I personally recommend for long-term mining strategies.

Bitcoin coins stand out in the crypto crowd because their community-driven nature constantly pushes innovative upgrades and adoption.